Unleashing the Potential of Impact Investing & Unlocking Private Assets for Impact

The Individual Impact Investing Commission Report

It’s a promising time for impact investing. The Individual Impact Investing Commission, an innovative collaboration between Big Society Capital and The Beacon Collaborative, and supported by the Connect Fund, has been hard at work to better comprehend the challenges preventing wealthy individuals and families from embracing impact investing.

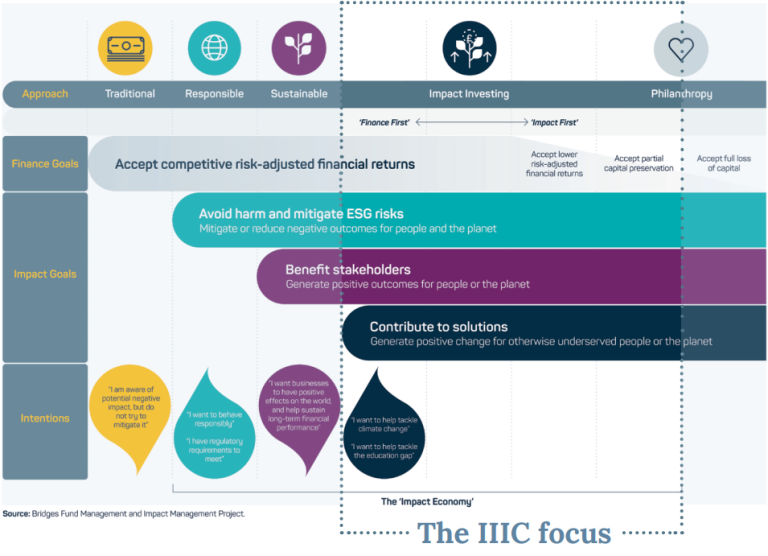

The Commission published a report arguing that many high-net-worth individuals (HNWI) and affluent families are keen on a value-led approach to wealth management, particularly the younger generation. However, due to the lack of resources similar to those accessible by institutional investors or fund managers, these potential impact investors face numerous barriers. These range from uninformed advisors to a dearth of impact management data.

The Commission’s report sheds light on five key barriers:

- A lack of impact investment knowledge and marketing expertise.

- The need for values-centric advice on impact investing options.

- An absence of suitable investment products.

- Limited understanding of tax reliefs, related incentives, and the need for innovation.

- Low uptake of impact investment through charitable giving vehicles.

The report proposes several strategies to dismantle these barriers, including professional accreditation for financial advisors to ensure their proficiency in offering impact investment advice, establishing clients’ appetite for impact investment, designing new networks and events to attract investor interest, and urging the government to increase support.

The Commission itself comprised 11 leading figures in the impact investing sphere, whose rich experiences and insights have shaped this pivotal report and was supported by the Connect Fund, managed by Barrow Cadbury. Dame Sara Llewellin, Chief Executive Barrow Cadbury Trust, commented, “There is a new generation of HNWIs seeking more than just profit, but to invest in benefitting people and our planet. It is vital we grow this movement, as the capital is uniquely flexible and potentially patient.”

We at the Connect Fund join our partners in hoping that this report will be a catalyst in sparking dialogue on how to traverse the impact investment market. By working together to create impact with capital, we can unlock the immense potential that private assets hold.

The full report is available here.

We’re excited about the future of impact investing and the vast opportunities it holds for making our world a better place. It’s clear that with a value-led approach, we can make significant strides towards addressing the world’s most pressing challenges.